HomeSelfe is dedicated to helping you learn the ins and outs of saving energy in your home. Why? It’s simple—the less energy you use, the less coal, oil, and other fossil fuels will need to be burned to generate electricity, which means the environment will not be exposed to as many power plant emissions.

In addition to protecting the environment, you can also save money by making energy efficient upgrades around the home. The less energy you use in your home, the less you will spend on monthly utility bills. In fact, it’s possible to save hundreds of dollars on your utility bills every year, but the exact amount you save will depend on what upgrades you make.

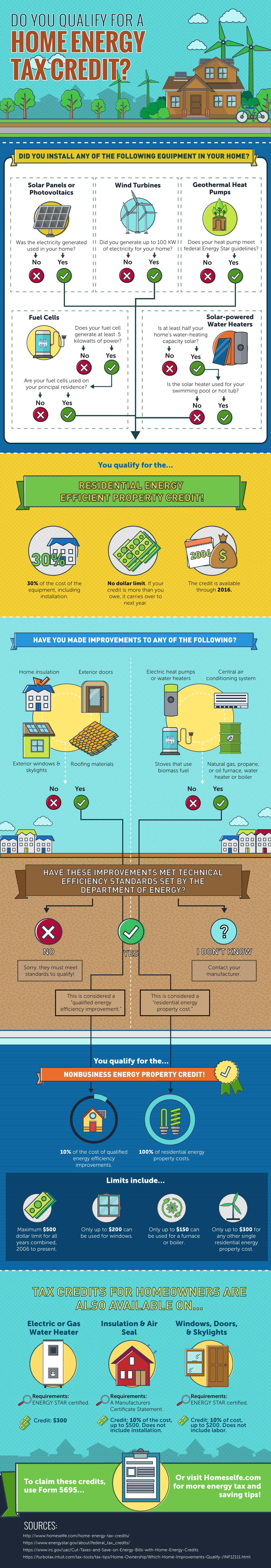

So why aren’t more homeowners making an effort to become energy efficient? Some energy efficient upgrades, such as installing solar panels, can be quite pricey. But, if the price of an upgrade is holding you back, it’s important to learn about home energy tax credits that can help you cover the costs.

The federal government offers several different tax credits to homeowners who have made an effort to improve their home’s energy efficiency. Why? Being energy efficient benefits us all, so these credits were established to motivate more homeowners to take the leap and start saving energy at home.

If you qualify for these tax credits, you could recoup a large portion of what you spent on making your home more energy efficient when you do your free efile. These tax credits, combined with the amount you save on your utility bills every year, make upgrading to an energy efficient home a smart decision for homeowners across the country.

The tax deadline for 2016 is quickly approaching, so there’s no time to waste! Learn more about whether you qualify for home energy tax credits by taking a look at this helpful infographic: