“Just a few quid” is how most modern spending starts. A £3.99 upgrade, a £5 top-up, a cheeky midweek subscription trial – small enough to feel harmless, frequent enough to add up fast.

The good news: you don’t have to ditch digital entertainment to feel back in control. You just need a way to keep the fun… fun.

If you like the idea of low-effort, budget-friendly entertainment (especially for a cosy night in), one easy place to start is free bingo cards you can play with friends or family – no downloads, no faff, just print-and-play.

And if bingo is part of your wider “little treats” rotation, it’s worth browsing options before you spend so you can pick something that fits your budget and preferences – for example, you can compare UK bingo sites in one place rather than impulse-clicking whatever pops up first.

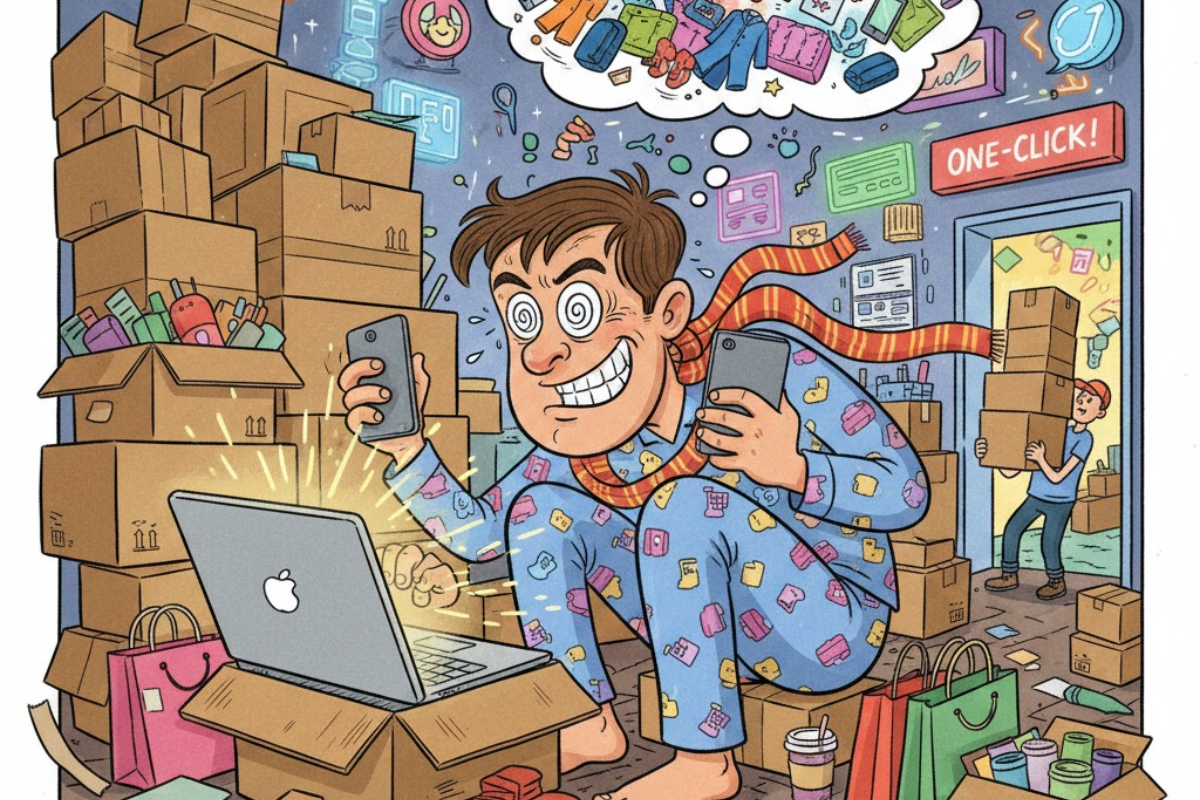

Micro-spends: the tiny charges you barely notice

Micro-spends aren’t just shopping; they’re the small, repeat payments tucked into daily life:

- Subscriptions (streaming, music, fitness apps)

- In-app purchases (add-ons, ad-free upgrades)

- Low-cost entertainment (a small top-up here and there)

- Convenience extras (delivery add-ons, “priority” access)

None of these are automatically “bad”. The problem is when they become invisible – spread across platforms, taken automatically, and too small to trigger your internal alarm system.

Mood-spends vs planned spends (the difference that saves you money)

A planned spend is a treat you actually chose: “I’m setting aside £X this month for fun and I’m happy with that.”

A mood-spend is more emotional: boredom, stress, a long day, wanting a quick lift. Mood-spends are normal – they’re just easier to regret because you didn’t really decide.

A simple check that works:

“Would I still want this tomorrow morning?”

If not, it’s probably a mood-spend. You don’t need to ban it, you just need a system so mood-spends don’t quietly run your month.

The Fun Fund: a simple budget that protects enjoyment

Instead of trying to be “good” (and then snapping), give entertainment money a home.

1) Pick a number you can repeat

Choose a monthly “Fun Fund” that won’t leave you anxious later. If you want a quick way to map out what’s realistic, MoneyHelper’s budget planner is genuinely handy: MoneyHelper budget planner.

2) Split it into two buckets

This stops subscriptions swallowing everything.

- Bucket A: Fixed fun (subscriptions you use weekly)

- Bucket B: Flexible treats (occasional paid entertainment)

Try 70/30 to start:

- 70% fixed

- 30% flexible

If your fixed costs are already 90%, that’s not “bad budgeting” – it’s just a sign your subscriptions need a tidy-up.

3) Make overspending mildly inconvenient

Friction is the secret weapon. Try one:

- Keep the Fun Fund on a separate card/account

- Turn off one-click payments

- Require a password for every purchase

This doesn’t kill the vibe – it keeps treats intentional.

The subscription sweep: reclaim money without feeling deprived

Once a month, do a 15–20 minute sweep:

- Search your banking app for “subscription”, “monthly”, and the big platforms (Apple/Google/Amazon/PayPal)

- Write down everything – yes, even the £1.99 bits

- Ask:

- “Do I use this weekly?”

- “Would I pay for this again today?”

- Cancel anything that doesn’t earn its place

This is the fastest way to free up money for the stuff you actually enjoy.

A more satisfying way to do “little treats”: build a mini ritual

A lot of micro-spending is just a search for a tiny moment of reward. If you swap “random treats” for a planned mini ritual, you often spend less and enjoy it more.

Try one of these:

The Friday Night Fun Plan

Pick a weekly cap (e.g., £10–£20) and make it a ritual:

- snack + movie

- board game night

- bingo night

If you want a low-cost, easy setup, you can grab a theme from free bingo cards and make it into a whole vibe – drinks, snacks, prizes that cost pennies, and a bit of friendly chaos.

The “Two Treats” Rule

You’re allowed two digital treats per week. Anything else waits.

It’s simple, and it works because it doesn’t feel like deprivation.

The Pause Rule

If it’s under £10, wait 24 hours.

If it’s over £10, wait 72 hours.

Most things you truly want will still feel worth it – and you’ll buy them with zero guilt.

If bingo is part of your entertainment mix, make it a “planned spend” not a “scroll spend”

Bingo works best as entertainment when it’s treated like everything else in your Fun Fund: occasional, chosen, and part of a planned night – not a random click after a long day.

If you’re considering playing online (18+ only), it helps to start by browsing what’s available so you can pick something that fits your style and budget. A simple way to do that is to compare UK bingo sites so you’re making an informed choice rather than going with the first ad you see.

Quick signs your micro-spends are running on autopilot

This is less about “bad habits” and more about catching patterns early. You might need tighter guardrails if:

- You’re surprised by your month-end total

- You’ve got subscriptions you “might use” but don’t

- Your treats feel more like habit than enjoyment

- You’re constantly topping up without remembering why

If any of those land, don’t panic – just go back to basics: Fun Fund, subscription sweep, friction, and a weekly ritual.

Key takeaway: keep the treats, lose the regret

- Micro-spends aren’t the enemy – untracked micro-spends are.

- A Fun Fund keeps entertainment enjoyable and guilt-free.

- A monthly subscription sweep frees up money fast.

- A weekly ritual makes “little treats” feel bigger (and cost less).

- Free, social options like printable bingo nights can be genuinely fun without quietly draining your budget.