This is a sponsored post with information provided from Walgreens. All opinions are my own

The fact that Americans are living longer more fulfilling and healthy lives is no secret. Technology and Medicine have come a long way to provide us the things we need to stay active and strong. Working closely with doctors and pharmacies is the only way to stay informed about what is working to maintain the level of care needed.

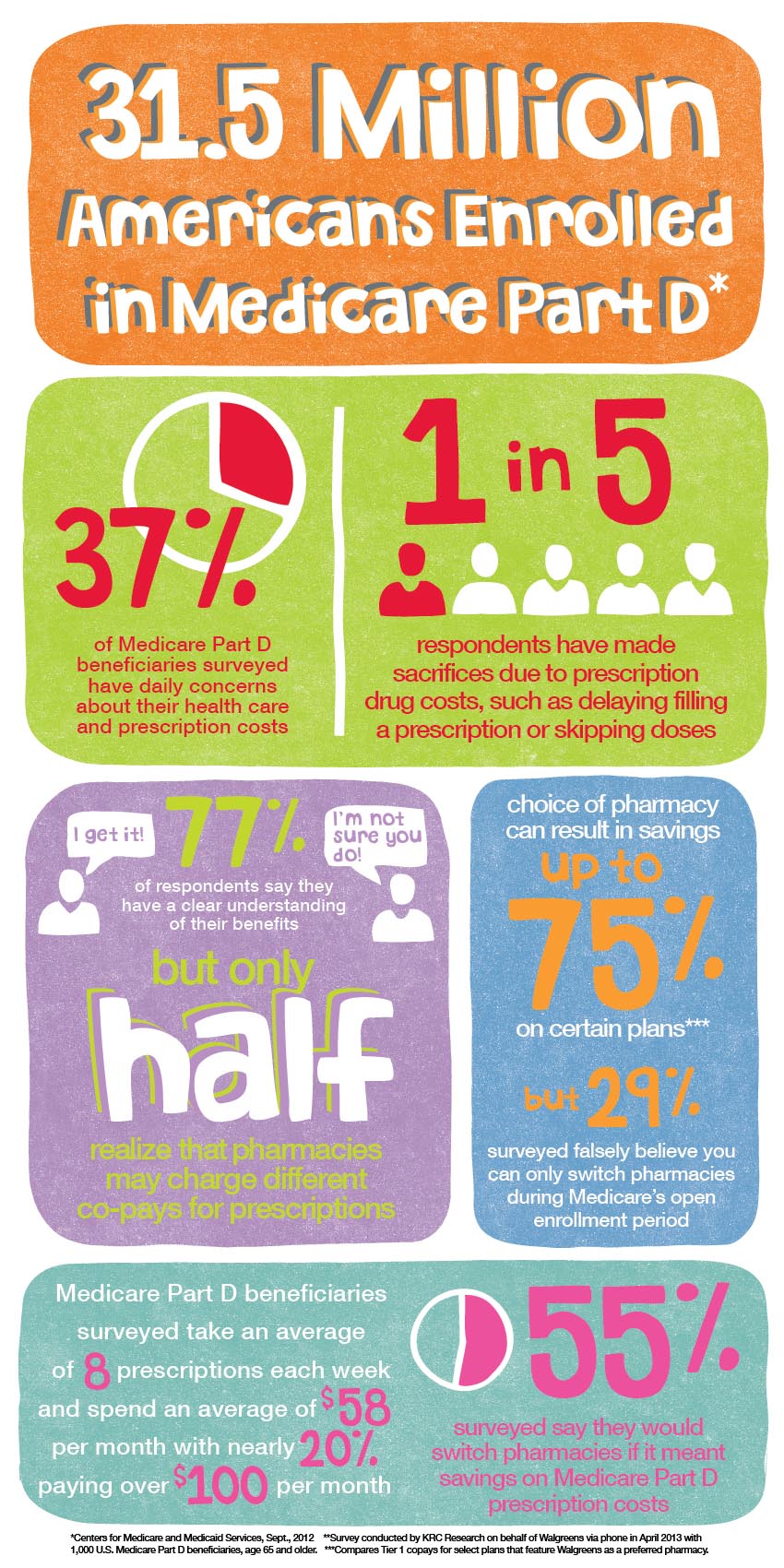

More than one-third of Medicare Part D beneficiaries surveyed (37 percent) have daily concerns about their prescription drug costs and 1 in 5 say they’ve had to make sacrifices, such as delaying filling a prescription or skipping doses, to help manage medication costs, according to a new Walgreens survey.

Medicare Part D isn’t for everyone. Eligibility comes with age or a qualifying disability but that doesn’t mean knowledge of the benefits couldn’t be an advantage to someone you know and love.

Medicare Part D isn’t for everyone. Eligibility comes with age or a qualifying disability but that doesn’t mean knowledge of the benefits couldn’t be an advantage to someone you know and love.

As Americans get older health and prescription drug coverage changes. Health benefits change with insurance providers and employers so keeping track of these details for your older family and friends may help them with their costs. In some cases Medicare Part D can even help save money by using preferred pharmacies such as Walgreens.

My grandfather has been using the same pharmacy for many many years. I’m sure with a little chat we can change him over to a preferred pharmacy to help save him some money during his retirement.

Living on a fixed income comes with its own disadvantages such as less cushion to fall back on when a personal or medical emergency arises. This is why it’s so important to educate yourself about how Medicare works. Walgreens You’re Worth Savings initiative aims to inform patients and consumers about the cost saving opportunities available. Utilizing these measures will help them get the most from their prescription drug plan.

Visit a local Walgreens to talk with a pharmacist and see if making a switch would work for you or an older friend or family member.