The niche market for marijuana-connected companies is still very small, but it’s gathering a lot of steam. In recent weeks, two companies with large market caps have made significant headlines.

As you may know, cannabis stocks are extremely volatile and difficult to trade in, due to the nature of the marijuana industry. However, a new cannabis product is emerging that is making waves in the industry. This product, Potbox, is a cannabis concentrate unit that has been gaining popularity in the industry. Potbox is a small, discreet, and portable unit that requires no assembly or prep work. The Potbox comes with a pre-filled cartridge and contains a quality flower. The unit is managed by an app on your phone which allows you to track your inventory and monitor your consumption. While a completely new concept, the product is growing in popularity. Now, it appears that another company

George Leong, BA. Published on 18. May 2021

OrganiGram shares have a high risk/return ratio

Weed shares are under pressure after reaching multi-year highs in mid-February during a wave of buying triggered by Reddit. The vast majority of marijuana stocks have experienced a correction of more than 30-60% from their February levels. Such is the case with OrganiGram Holdings Inc (NASDAQ:OGI), a vertically integrated producer of medicinal and recreational cannabis. OrganiGram is currently a pure player in the Canadian herbal market and has a small presence in Germany and Israel. The company does not currently have the capacity to enter the potentially huge cannabis market in the United States. However, I wouldn’t be surprised if OrganiGram opened a facility there as the country continues to legalize recreational firearms.

Reduced but not eliminated for OGI actions

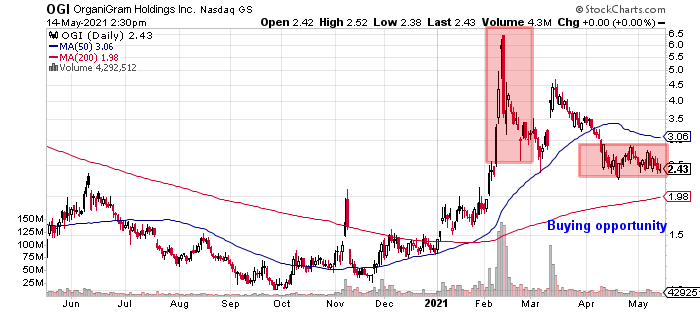

OrganiGram shares were listed on Feb. 11 at $6.45, but the next three months were unforgiving for OrganiGram Holdings Inc. OGI stock has lost 60% since February, even though it is up 88% this year. In the chart below, OrganiGram is trading cautiously in a narrow sideways channel bounded by the 50-day moving average as resistance and the 200-day moving average around $2.00. A drop in OGI stock to its 200-day moving average, which is a 17% drop from its current price, would be a good opportunity. The key level has held up in the past as well.  Graph courtesy of StockCharts.com

Graph courtesy of StockCharts.com

Revenue is expected to increase and profitability is in sight

OrganiGram Holdings Inc reports for the year ended 31. the fiscal year ended August. The company’s revenues increased from C$6.1 million in 2016 to C$86.8 million in 2020, representing a compound annual growth rate (CAGR) of 95%. Revenue growth fell to 7.9% during the 2020 COVID 19 pandemic and is expected to continue to decline this year.

| Fiscal year | Revenue (millions of Canadian dollars) | Growth |

| 2016 | $6.1 | N/A |

| 2017 | $5.4 | -12.1% |

| 2018 | $12.4 | 130.6% |

| 2019 | $80.4 | 547.0% |

| 2020 | $86.8 | 7.9% |

(Source: OrganiGram Holdings Inc MarketWatch, last accessed May 14, 2021). Analysts estimate that OrganiGram’s sales will decline 16.8% to $72.2 million in 2021, depending on the economic recovery in Canada, where the pandemic remains a major concern. (Source: OrganiGram Holdings Inc (OGI), Yahoo! Finance, last accessed May 14, 2021). The good news is that there are signs of economic improvement in Canada. Not surprisingly, analysts expect OrganiGram’s revenue to increase 57.8% to C$113.9 million in 2022. Right now, the most important thing for OrganiGram is the revenue stream and the ability to control costs and reduce losses. OrganiGram has reported negative earnings before interest, taxes, depreciation and amortization (EBITDA) for the past four years, but I expect things to improve as the company reduces costs and increases revenues.

| Fiscal year | EBITDA (millions of Australian dollars) | Growth |

| 2016 | $1.7 | N/A |

| 2017 | -$8.2 | -568.1% |

| 2018 | -$11.9 | -45.5% |

| 2019 | -$60.3 | -407.2% |

| 2020 | -$161.7 | -168.1% |

(Source: MarketWatch, op. cit.) OrganiGram Holdings Inc. is making a loss on both a GAAP and adjusted earnings per share (EPS) basis.

| Fiscal year | GAAP diluted earnings per share (C$) | Growth |

| 2016 | $0.01 | N/A |

| 2017 | -$0.11 | -900.0% |

| 2018 | $0.16 | 244.4% |

| 2019 | -$0.07 | -141.9% |

| 2020 | -$0.79 | -1,064% |

(Source: MarketWatch, op. cit.) As the company keeps its costs under control, we should see improvements. OrganiGram Holdings Inc. is expected to reduce its adjusted loss in 2021 to C$0.43 per diluted share. This is despite the fact that the company’s revenues will decline in 2021. (Source: Yahoo! Finance, op. cit.) This figure is expected to improve to a loss of C$0.08 per diluted share in 2022. OrganiGram had negative free cash flow, but the company’s focus on cost reduction should increase free cash flow.

| Fiscal year | Free cash flow (in millions of Canadian dollars) | Growth |

| 2016 | -$6.6 | 36.7% |

| 2017 | -$40.2 | -509.5% |

| 2018 | -$71.9 | -79.0% |

| 2019 | -$148.8 | -107.0% |

| 2020 | -$126.0 | 15.3% |

(Source: MarketWatch, op. cit.)

Analyst

In my opinion, OrganiGram Holdings Inc.’s projected revenue growth and trajectory to adjusted profitability by 2022 are encouraging. The performance of OrganiGram’s shares will largely depend on the recovery of the Canadian economy and continued vaccine sales. A final consideration is that the relatively small size of OrganiGram opens up the possibility of acquisitions.

Related Tags:

top marijuanas penny stocks 2020list of cannabinoids stocksu.s. mso pot stockscbd stocks to watchbest marijuanas stocks 2021 redditcanopy growth stock,People also search for,Privacy settings,How Search works,Green Thumb Industries,Canopy Growth Corporation,Sundial Growers,Tilray,Cresco Labs,Curaleaf Holdings,See more,top marijuanas penny stocks 2020,u.s. mso pot stocks,cbd stocks to watch,best marijuanas stocks 2021 reddit,canopy growth stock,cbd companies to invest in,curaleaf stock,marijuanastocks.com reviews