HEXO Corp. (TSXV:HEXO)(OTC:HYYDF) is a Canadian based company that is focused on the production, sale, and distribution of marijuana. They have built a large market presence by becoming the leading producer of cannabis oil in Canada. HEXO has gone on to produce an impressive 47,500kg of cannabis oil in their facility located in Mountain View, BC. HEXO stock also has a market cap of $760 million, and this company has seen a rapid growth in the last year, and it is now trading at an historic high of $11.50 per share. HEXO is a penny stock, and that has made it quite attractive for traders to buy shares in

It was only a matter of time before cannabis would be legalized in the United States, and it looks like that time is now. There are several companies that are cashing in on the growing demand for marijuana, and one of them is HEXO. This company is known for its rapid expansion in the cannabis industry, and its recent introduction of cannabis-infused beverages aims to do the same for its stock. Although marijuana is still illegal at the federal level, it is legal in Canada and 30 states in the United States, and it is expected to be legalized at the federal level in the US in the near future. If you want to capitalize on this growth in the cannabis market, you might want to consider investing

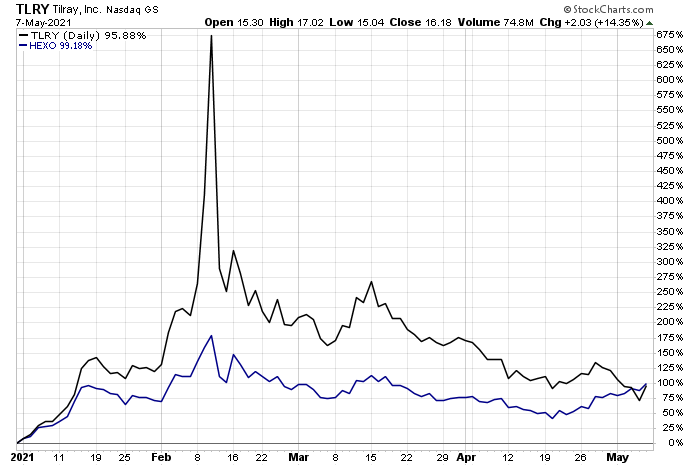

HEXO shares lead marijuana shares in 2021

There has been no shortage of high-profile stories about the value of marijuana this year. Mergers, political maneuvering, attempts at legalization – cannabis values have not been dull this year. But marijuana stock investors should never lose sight of the stocks that have the greatest upside potential. In my opinion, HEXO Corp (NYSE:HEXO) is the stock that investors should be paying attention to right now. HEXO stock has risen over 250% in the last 12 months. This will come as no surprise to my loyal readers. I’ve been bullish on HEXO stocks for years. I have long seen this company as a potential leader in the future of the marijuana industry, thanks to its partnership with alcohol producer Molson Coors Beverage Co (NYSE:TAP). The two companies struck a deal at a time when cannabis-infused drinks were seen as one of the most exciting prospects in the marijuana market. In addition, HEXO Corp has a strong position in Quebec, Canada’s second most populous province. The dynamics of weed actions did not diminish in 2021. The company’s share price nearly doubled in the first five months of 2021.  Graph courtesy of StockCharts.com So what caused the huge rise in HEXO shares? First, the company has delivered solid financial performance. I am very proud of the entire HEXO team for the role they played in achieving positive adjusted EBITDA this quarter, as well as the seventh consecutive quarter of adjusted EBITDA improvement, said Sebastien Saint-Louis, CEO and co-founder. (Source: HEXO Corp. reports positive adjusted EBITDA and 94% year-over-year increase in net income, GlobeNewswire, March 18, 2021). He added, Our continued focus on consumer satisfaction has allowed us to increase our market share across Canada and maintain our number one position in Quebec. We are also very excited to launch HEXO [cannabidiol] powered drinks in Colorado. Our net income and gross margin continued to improve year-over-year, helped by our premium product mix following the relaunch of UP Cannabis. (Source: Ibid). HEXO Corp.’s total net income was C$32.8 million, up 94% from the same period last year and 12% from the previous quarter. Recreational marijuana sales, excluding beverages, also rose sharply, up 72% year-on-year and 10.5% year-on-year from the previous quarter. HEXO also has C$2.9 million in operating cash flow, which bodes well for a growing cannabis company. All these figures demonstrate HEXO Corp.’s strong position in the Quebec market (the company is currently number one, with few real competitors contesting this position) and its increasing activities in the rest of Canada, which represents 49% of the company’s total sales. So the numbers are good, but that’s not the only reason why HEXO stock is doing so well. In the early days of the COVID 19 pandemic, many investors turned to safe assets. They feared an imminent collapse of the market as the global economy slowed here and there and stagnated in others. But that crash never happened. It’s the opposite. Stocks in all sectors (especially technology stocks) have shown extraordinary growth even as the world has experienced a unique pandemic that has drastically changed the way we live and sent unemployment skyrocketing. However, one segment of the equity market suffered, namely emerging markets. After all, why would an investor participate in typically volatile markets during a period of extreme negativity? At least, that’s what they thought. This view, of course, turned out to be incorrect. I’ve often noted that in times of economic turmoil and uncertainty, sales of harmful products (marijuana being one of them) tend to rise. As the saying goes, a drink or a cigarette can help you relax, and in living memory there has never been a more poignant moment than a global pandemic and forced government shutdowns around the world. Investors eventually calmed down when the market didn’t collapse and we got used to the new normal, as they call it, when marijuana sales really started to rise in Canada and legalization spread to some of the larger US states like New York. As a result, the shares of many cannabis companies have risen dramatically. HEXO stock was in a particularly strong position because it is a penny stock for marijuana. Since penny stocks are considered among the most vulnerable stocks and emerging industries are known for their volatility, this leads to the perception that marijuana penny stocks are twice as volatile and therefore twice as dangerous in times of great economic uncertainty. Given that HEXO stock has already fallen since mid-2019 and has its penny stock status, it lost even more in February and March 2020, coinciding with the start of the pandemic. In general, the market has overvalued HEXO’s stock price, which has paved the way for its tremendous growth in recent months as investors became aware of HEXO’s potential. Is there still room for improvement in the HEXO share? In my opinion, absolutely. At one point, HEXO was close to $30 a share. It is now close to the $7.50 level, leaving plenty of room for upside.

Graph courtesy of StockCharts.com So what caused the huge rise in HEXO shares? First, the company has delivered solid financial performance. I am very proud of the entire HEXO team for the role they played in achieving positive adjusted EBITDA this quarter, as well as the seventh consecutive quarter of adjusted EBITDA improvement, said Sebastien Saint-Louis, CEO and co-founder. (Source: HEXO Corp. reports positive adjusted EBITDA and 94% year-over-year increase in net income, GlobeNewswire, March 18, 2021). He added, Our continued focus on consumer satisfaction has allowed us to increase our market share across Canada and maintain our number one position in Quebec. We are also very excited to launch HEXO [cannabidiol] powered drinks in Colorado. Our net income and gross margin continued to improve year-over-year, helped by our premium product mix following the relaunch of UP Cannabis. (Source: Ibid). HEXO Corp.’s total net income was C$32.8 million, up 94% from the same period last year and 12% from the previous quarter. Recreational marijuana sales, excluding beverages, also rose sharply, up 72% year-on-year and 10.5% year-on-year from the previous quarter. HEXO also has C$2.9 million in operating cash flow, which bodes well for a growing cannabis company. All these figures demonstrate HEXO Corp.’s strong position in the Quebec market (the company is currently number one, with few real competitors contesting this position) and its increasing activities in the rest of Canada, which represents 49% of the company’s total sales. So the numbers are good, but that’s not the only reason why HEXO stock is doing so well. In the early days of the COVID 19 pandemic, many investors turned to safe assets. They feared an imminent collapse of the market as the global economy slowed here and there and stagnated in others. But that crash never happened. It’s the opposite. Stocks in all sectors (especially technology stocks) have shown extraordinary growth even as the world has experienced a unique pandemic that has drastically changed the way we live and sent unemployment skyrocketing. However, one segment of the equity market suffered, namely emerging markets. After all, why would an investor participate in typically volatile markets during a period of extreme negativity? At least, that’s what they thought. This view, of course, turned out to be incorrect. I’ve often noted that in times of economic turmoil and uncertainty, sales of harmful products (marijuana being one of them) tend to rise. As the saying goes, a drink or a cigarette can help you relax, and in living memory there has never been a more poignant moment than a global pandemic and forced government shutdowns around the world. Investors eventually calmed down when the market didn’t collapse and we got used to the new normal, as they call it, when marijuana sales really started to rise in Canada and legalization spread to some of the larger US states like New York. As a result, the shares of many cannabis companies have risen dramatically. HEXO stock was in a particularly strong position because it is a penny stock for marijuana. Since penny stocks are considered among the most vulnerable stocks and emerging industries are known for their volatility, this leads to the perception that marijuana penny stocks are twice as volatile and therefore twice as dangerous in times of great economic uncertainty. Given that HEXO stock has already fallen since mid-2019 and has its penny stock status, it lost even more in February and March 2020, coinciding with the start of the pandemic. In general, the market has overvalued HEXO’s stock price, which has paved the way for its tremendous growth in recent months as investors became aware of HEXO’s potential. Is there still room for improvement in the HEXO share? In my opinion, absolutely. At one point, HEXO was close to $30 a share. It is now close to the $7.50 level, leaving plenty of room for upside.

Analyst

The market for marijuana stocks is heating up again, and we’re seeing many companies I’ve been positive about in the past come back into the picture. And that brings me back to HEXO Corp and its potential for huge gains in the coming months. While HEXO stock has certainly already shown explosive growth over the past year, which might lead some investors to think it’s too late, HEXO stock hasn’t even come close to its all-time high, a level I think it could reach in the next 12 months or so. This means that triple-digit growth for HEXO stock is very possible, making it very attractive to investors.

Related Tags:

top penny stocks todaybest penny stocks for 2021 robinhoodpenny stocks about to explode 2021best penny stocks for 2021 under $1penny stock news tickerpenny stock list,People also search for,Privacy settings,How Search works,top marijuanas penny stocks 2021 robinhood,top marijuanas penny stocks 2020 robinhood,top penny stocks today,best penny stocks for 2021 robinhood,penny stocks about to explode 2021,best penny stocks for 2021 under $1,penny stock news ticker,penny stock list