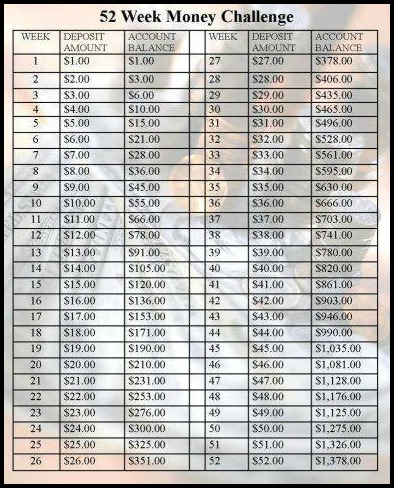

For the last week I saw this image floating around Facebook and blogs. I looked at it but I didn’t pay much attention to it. I understood that you had to set aside money but thought it was daily and knew that would’ve been impossible.

Here is a downloadable/printable version from my frugal friend Lisa Lightner from her Easy Savings post.

Here is a downloadable/printable version from my frugal friend Lisa Lightner from her Easy Savings post.

On Friday I took an extra moment to REALLY read about it and figured this was something we could definitely do. Right now finances are tough but we can definitely gather the $1, $2, $3 and $4 to put away. The 52 Week Money Challenge is a simple way to force yourself to save money each week. Will it make you rich? NO! But at the end of the year you’ll have a nice chunk of money to go towards a vacation, room makeover, new car, tuition or whatever you want.

Rob and I instantly gathered up the change in my wallet and an archaic container to hold each weeks deposit. The crafty mama in me cringes as I look at it but I knew if I didn’t put that money away instantly we’d quickly lose interest and forget.

So I superglued a Chinese Wonton Soup container closed, cut a slit in the top and with a Sharpie wrote down the weeks that have been deposited. I have $6 in my wallet so it all went in. I also wrote down 1, 2, 3 so we’d know where we were during the process.

Right now adding a couple bucks doesn’t seem hard but when it comes to October-December, close to the holidays it will get harder. We’ll find excuses not to put money in it but we have to be determined to get to $1378. The system can be switched to start with $52 deposit this week working your way to $1. Right now I don’t have those funds so we’re gonna do it this way.

Don’t think that you HAVE to physically add dollar bills to a piggy bank. You can set up new savings account through your bank and arrange direct deposit so that it can be done online. I thought it would benefit us if we could actually SEE the money being stashed away, like an encouragement. It it works against us then we will be moving it to a financial institution.

Crossing our fingers!

She’s spending more time with friends shopping, eating, hanging out on Main Street. She’s got her phone, her iPod and now her own PASS Card from American ExpressSM. All she needs is her license and car and she won’t need Mommy and Daddy anymore; that is until she runs out of money on her PASS Card.

She’s spending more time with friends shopping, eating, hanging out on Main Street. She’s got her phone, her iPod and now her own PASS Card from American ExpressSM. All she needs is her license and car and she won’t need Mommy and Daddy anymore; that is until she runs out of money on her PASS Card.