If you want to invest in legal cannabis stocks, you’re not alone. A number of people have seen the existential threat the plant poses to Big Pharma, and have made the leap to the big leagues of cannabis investment. However, with the amount of competition in this burgeoning industry and regulation still in flux, there are still risks.

Cannabis stocks have been on a tear since the U.S. Attorney General Jeff Sessions rescinded federal prohibition on marijuana, making it legal for companies to invest in their own businesses. The stock market, which has seen two major pullbacks in 2018, is now on the verge of a major bull market. With marijuana’s legalization, there is also a new market opportunity for investors, with companies that have been in the cannabis industry for decades being able to capitalize on the industry’s growth. There are now over 500 publicly traded cannabis companies worldwide, according to Marijuana Business Daily.

When Democrats won the US election in November, cannabis investors were excited about the possibility of comprehensive cannabis reform. Now, 90 days into the Biden administration, we have a much better idea of what to expect. While it appears that the reforms will not reach the holy grail of federal legalization, I consider it likely that cannabis reform in 2021 will be a game changer. Any recent findings? On Tuesday, the United States House of Representatives passed a cannabis banking bill called the Safe Act. Here are some details from Marijuana Business Daily. On Monday, the U.S. House of Representatives approved cannabis banking reform by a 321-101 majority, marking the first major marijuana legislation passed by the new Democrat-controlled Congress. More than half of the Republicans who cast their votes supported the bill. Every Democrat who voted approved the measure. The measure, known as the SAFE Banking Act, would allow banks and other financial institutions to operate marijuana-related businesses that are legal in the state without fear of federal penalties. The House of Representatives passed a similar cannabis bank reform bill in the last legislative session of fall 2019 by a bipartisan vote of 321-103. But the bill foundered in the then Republican-controlled Senate, so everything had to be started over in the new two-year legislative session that began in January.

What is happening now with the SAFE Act?

While House approval is a step in the right direction, it seems the bill has hit a wall. Sen. (D-NY) Chuck Schumer says the bill won’t pass the Senate because it doesn’t have the support of Democrats who want a bigger, more comprehensive bill. This division among Democrats highlights an important issue for lawmakers: Should legalization be done gradually or through comprehensive legislation, which is harder to pass but covers more people? Despite short-term controversy over the nature of legalization – the stage is set for major reform in 2021. That’s how I expect it to go. I expect lawmakers to pass a comprehensive cannabis law in 2021 that includes legalization at the federal level. Schumer has been working with Senate Finance Committee Chairman Ron Wyden (RN) and Senator Cory Booker (D-NJ) on a comprehensive cannabis bill since March. They recently said it would be on the table soon. Ultimately, I don’t expect this bill to pass, because federal legalization is still a bridge too far. This would lead to a compromise that would still include meaningful cannabis reform. I see a high probability that this includes :

- federal decriminalization

- Review of the status of cannabis as a non-toxic substance

- Updating of banking and tax legislation

- give the states more power to legalise

Any of these reforms would be a major victory for the U.S. cannabis industry. Getting two or more will be critical, likely leading to tens of billions of dollars in new investment.

Is this a good time to buy cannabis stocks?

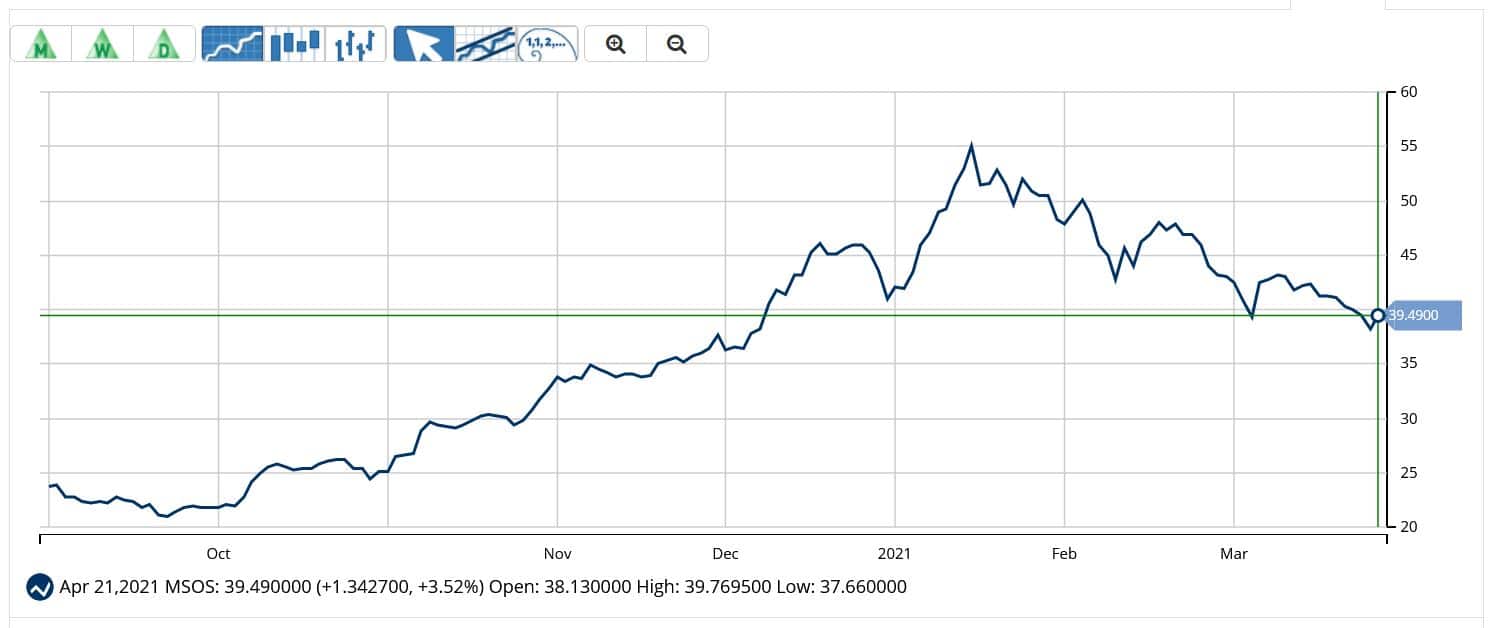

For investors looking for lucrative deals, now is a good time to take a fresh look at cannabis stocks. While the U.S. cannabis industry is on the cusp of a strong catalyst, cannabis stocks have been in a bear market. Advisor Shares Pure Cannabis ETF (MSOS) is down 30% from its 52-week high. 6 Monthly chart The Advisor Shares Pure Cannabis ETF (MSOS)  The reason for the decline in the cannabis sector over the past two months is simple. Cannabis stocks experienced a huge rally in 2020, and after a big rally, it’s normal for traders and short-term investors to take some profits. This leads to a slight pullback and consolidation into a higher range. After that, stocks usually stabilize, and then the stage is set for another rally. That’s what I’m here for. This looks like a short-term pullback, and once the sector stabilizes, I expect the long-term uptrend to continue.

The reason for the decline in the cannabis sector over the past two months is simple. Cannabis stocks experienced a huge rally in 2020, and after a big rally, it’s normal for traders and short-term investors to take some profits. This leads to a slight pullback and consolidation into a higher range. After that, stocks usually stabilize, and then the stage is set for another rally. That’s what I’m here for. This looks like a short-term pullback, and once the sector stabilizes, I expect the long-term uptrend to continue.

Large image

While federal legalization is unlikely, I consider the likelihood of major cannabis reform in 2021 to be high. These include decriminalization at the federal level, regulatory review, updating of banking laws, and more control for states over local cannabis markets. I see each of these potential reforms as a powerful catalyst for cannabis action. It seems like a good time to take a fresh look at cannabis stocks. The sector is deep in a declining market with some potential legislative catalysts on the horizon. Want to know what I think are the best stocks in this sector? Join CST now and get instant access to our portfolio, trading alerts and analytics. Best,Michael Water Editor, Cannabis Effects Trading

About the author and cannabis stock trading

Michael Wodicka is an equity analyst with over 20 years of trading and investment experience. His research has received attention in some of the industry’s most respected publications. He has been investing and managing investors in the cannabis sector since 2013.  Mr. Vodicka offers his experience and advice to Cannabis Stock Trades members. Sign up for Cannabis Stock Trades and receive exclusive analysis from Mr. Water, trade alerts and a sample portfolio.

Mr. Vodicka offers his experience and advice to Cannabis Stock Trades members. Sign up for Cannabis Stock Trades and receive exclusive analysis from Mr. Water, trade alerts and a sample portfolio.