The U.S. cannabis industry is booming, and now the state of Michigan could be the cornerstone of its growth.

Billionaire Sean Parker has a business plan to make the most of the $1 billion Michigan already has in the marijuana industry. Parker, a co-founder of the on-demand music service Napster, told Bloomberg this week he plans to invest in the emerging cannabis industry, which he believes is a billion-dollar market. “I’m not saying that we’re going to be the next Microsoft, but I think that we could be the next Google,” Parker said. “We’re just at the start of where we can be.”

Michigan has quickly become one of the largest cannabis markets in the United States since it became legal in 2020. The latest sales figures show that cannabis sales in Michigan will exceed $1 billion by 2021. This would make Michigan one of the largest cannabis markets in the United States. Here are some details from MJ Biz Daily. Michigan’s medical and recreational marijuana market continues to post record monthly figures, with sales of $115.4 million in March, more than double those of March 2020. Michigan sales have been strong since the state launched its adult marketplace in 2019, totaling more than $500 million in the first full year of the program. According to the Detroit Metro Times, there are 260 recreational cannabis stores and 410 medical marijuana dispensaries in the state. These sales figures make Michigan one of the largest cannabis markets in the United States. And looking ahead, the Michigan cannabis industry is expected to experience record sales growth by the end of the year. Earlier this year, Michigan issued 45 new licenses for recreational cannabis and 46 new licenses for medical cannabis. These new licenses increase the number of pharmacies in Michigan by 14%. Naturally, investors want to know how they can take advantage of Michigan’s burgeoning cannabis market. Today I’m going to tell you about a promising young cannabis company that is one of the early market leaders in Michigan.

Startup wants to play in cannabis market Michigan

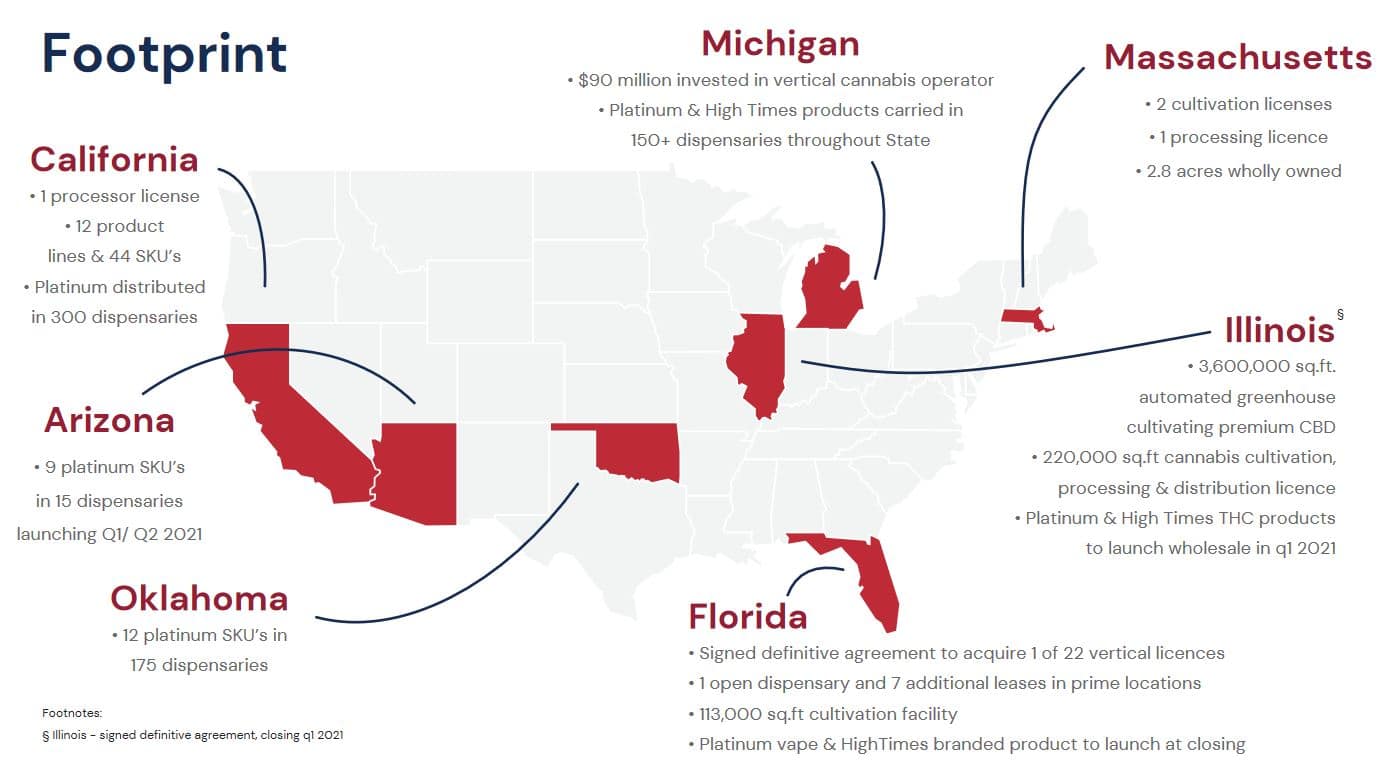

Red White and Bloom Brands (CSE: RWB, OTCQX: RWBYF) is betting directly on Michigan’s fast-growing cannabis industry. RSF, headquartered in Vancouver, British Columbia, has a market capitalization of $215 million and is a leader in the growing Michigan industry. On the retail side, RWB has eight pharmacies in Michigan. RWB also has two other clinics awaiting licensing and eight turnkey clinics under construction. On the cultivation side, RWB has three Michigan cultivation facilities, a new indoor facility currently under construction, and another indoor facility that has been purchased and is ready for construction. This gives RWB a total manufacturing capacity of 545,000 square feet in Michigan. While Michigan is the largest market for RWB, the company operates in a total of seven states, including California, Arizona, Oklahoma, Florida, Massachusetts and Illinois. Take a look at the diagram below. Imagefrom the Red White and Bloom website.  This portfolio of assets produces impressive results for RWB. In December, RWB reported third quarter results with tremendous revenue growth. Here are some details from the results report. Unaudited pro forma earnings, which include the upcoming acquisition of Michigan by PharmaCo and the completed acquisition of Platinum Vape and assume the acquisitions are completed by 1Q16. January 2020, would have been approximately C$48 million for the current quarter and C$48 million for the nine months ended January 30, 2020. September was C$128 million ; This report tells me that RWB should have over $100 million in revenue by 2021. This is an important figure as RWB currently has a market value of $215 million. That means RSF’s market value is only twice its annual revenue, making it one of the most undervalued companies in the entire U.S. cannabis industry.

This portfolio of assets produces impressive results for RWB. In December, RWB reported third quarter results with tremendous revenue growth. Here are some details from the results report. Unaudited pro forma earnings, which include the upcoming acquisition of Michigan by PharmaCo and the completed acquisition of Platinum Vape and assume the acquisitions are completed by 1Q16. January 2020, would have been approximately C$48 million for the current quarter and C$48 million for the nine months ended January 30, 2020. September was C$128 million ; This report tells me that RWB should have over $100 million in revenue by 2021. This is an important figure as RWB currently has a market value of $215 million. That means RSF’s market value is only twice its annual revenue, making it one of the most undervalued companies in the entire U.S. cannabis industry.

RWB shares offered for sale

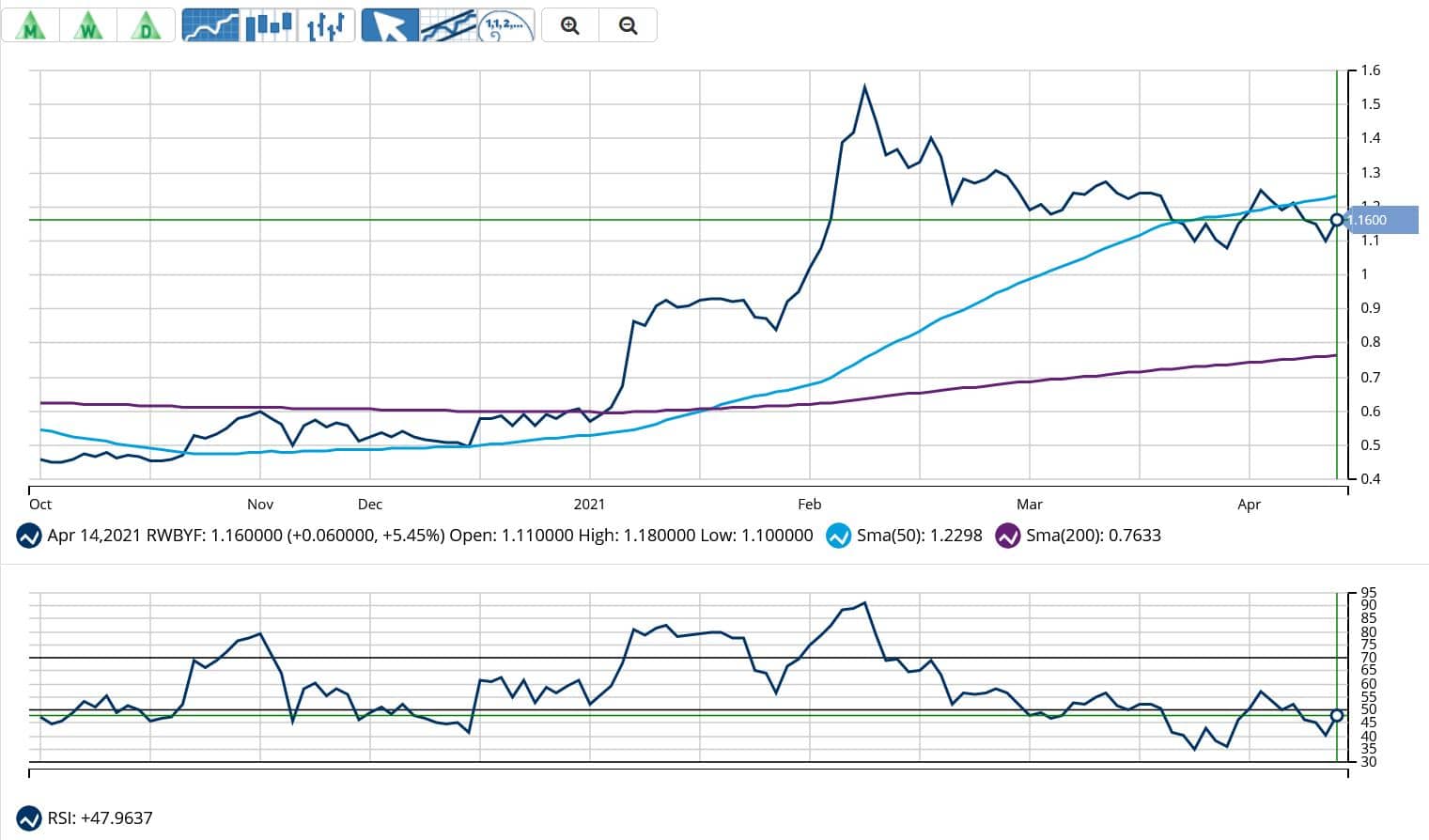

RWB shares rose sharply in 2020. However, the stock entered a bear market in 2021, down 30% from its 52-week high. The Relative Strength Index is a popular technical indicator that indicates whether a stock is overbought or oversold. The relative strength index below the chart indicates that the stock is more oversold than it has been in six months. Red White and Bloom Brands (CSE: RWB, OTCQX: RWBYF) 6-month chart

Large Michigan image and red, white and flowers

The cannabis market in Michigan has quickly become one of the largest and fastest growing markets in the United States. By 2021, sales will exceed $1 billion. Red, White and Bloom is one of the largest cannabis businesses in the United States and one of the first in Michigan. The stock is down 30% from its 52-week high. Moreover, the relative strength index offers an interesting entry point. Discover what else we have in our model portfolio and receive our trade alerts! Best,Michael Water Editor, Cannabis Effects Trading

About the author and cannabis stock trading

Michael Wodicka is an equity analyst with over 20 years of trading and investment experience. His research has received attention in some of the industry’s most respected publications. He has been investing and managing investors in the cannabis sector since 2013.  Mr. Vodicka offers his experience and advice to Cannabis Stock Trades members. Sign up for Cannabis Stock Trades and receive exclusive analysis from Mr. Water, trade alerts and a sample portfolio.

Mr. Vodicka offers his experience and advice to Cannabis Stock Trades members. Sign up for Cannabis Stock Trades and receive exclusive analysis from Mr. Water, trade alerts and a sample portfolio.

Related Tags:

dispensary owner demographicsaverage dispensary transactioncannabinoid market sizehow many customers do dispensaries haveaverage dispensary income 2020the u.s. cannabis report: 2020-2021 industry outlook,People also search for,Privacy settings,How Search works,the u.s. cannabis report: 2020-2021 industry outlook,dispensary owner demographics,average dispensary transaction,cannabinoid market size,how many dispensaries in united states 2020,how many dispensaries in united states 2021,how many customers do dispensaries have,average dispensary income 2020