This is a sponsored post. I am a Kmart blogger, though all opinions are my own.

Endless snow days this year and lingering holiday décor has stopped us in our tracks. I know here in Delaware were are slated to get an other 10 to 12 inches of snow overnight and needless to say I am tired of winter and so so ready for spring. It’s time for a change. Who’s in?

Nothing livens up your household (and your spirit) like a newly decorated home. This spring, we’re hearing things like ‘grey is the new beige’, ‘blue is in’ and ‘light wood finishes are back.’ Redecorating your home every time a new trend arises can be cruel to your wallet. Cue Kmart’s Semi Annual Home Sale! For many of us, winter has wreaked havoc on our homes and it is time to take our homes back. Check out this funny video HERE on why we ALL need to retake our home. This video reminds me a lot of our house minus the pillows exploding, LOL.

At the @Kmart Semi Annual Home Sale, you’ll find major savings on décor and furniture for your bed, bath, living room and kitchen. From bright colors to fresh finishes, you’ll save on everything you need to take your home from winter blues to stylish in spring. And with the points you’ll earn on redecorating, you’ll be able to redeem them on next season’s decorating trends.

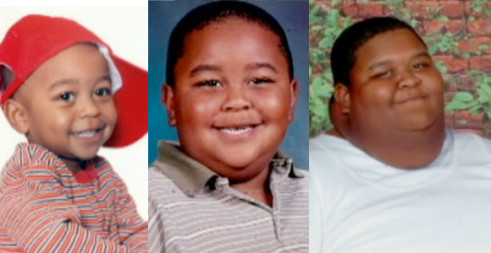

His mother, Jerri Gray, was charged with criminal neglect for letting him gain too much weight. Alexander was soon placed in foster care and stripped away from his mother, as she faced her looming trial (2 felonies, 15 years, $50k bond). During her trial, she claimed that she didn’t have the education to help him live a healthy lifestyle nor the finances to put him in the recommended weight loss program. IS THIS CRIMINAL NEGLECT OR SOCIAL INJUSTICE?

His mother, Jerri Gray, was charged with criminal neglect for letting him gain too much weight. Alexander was soon placed in foster care and stripped away from his mother, as she faced her looming trial (2 felonies, 15 years, $50k bond). During her trial, she claimed that she didn’t have the education to help him live a healthy lifestyle nor the finances to put him in the recommended weight loss program. IS THIS CRIMINAL NEGLECT OR SOCIAL INJUSTICE?