Being a Verizon customer comes with lots of perks; great service , wide coverage and useful apps. Isis Wallet is one of these useful apps. It’s an app that makes shopping easier at some of your favorite retail locations.

I can run my daily errands with just my car keys, phone and sunglasses in my hand and leave the purse in the car. In a 3 mile radius I can fuel up my car, grocery shop for the week, pick up prescriptions, take the dogs to their check-up, stock up on Rob’s favorite beer, Summer Shandy and pick up a gallon of locally made artisan ice cream.

That’s just in my little college town area. Imagine the shopping opportunities available in a larger market.

Starting up the Isis Wallet is simple. First confirm your carrier and phone is compatible.

Download the Isis Wallet app. If you receive a message that you require an enhanced SIM card to store and protect your sensitive payment information your carrier will provide this card free of charge in an authorized store.

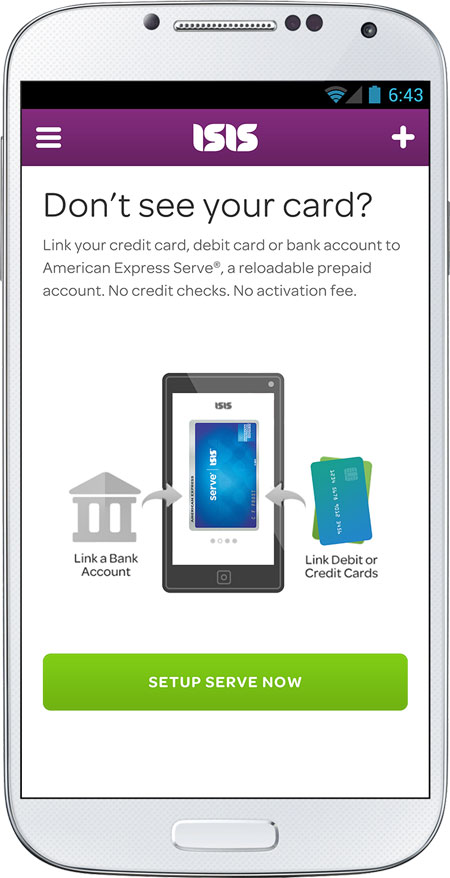

Add your debit card, credit card or bank account or your American Express®, Chase®, or Wells Fargo® credit card info and receive the same perks and benefits as a cardholder without actually holding the card. OterAdd loyalty and bonus cards from select merchants and find offers like free Jamba Juice or $1 back on purchases made from your American Express Serve Account.

Now you shop. Using the app you’ll find local retailers that accept Isis Wallet. Wave the back of your phone on the “contactless symbol” when instructed by the cashier and your payment will be made. Isis Mobile Wallet is accepted at hundreds of thousands of locations across the country including McDonald’s, Jamba Juice, Macy’s, Toys’R’Us, Coca-Cola vending machines, etc. To check out locations near you: https://www.paywithisis.com/where.html. That number grows making this app a great tool to have on hand.

If you sign up for the American Express Serve prepaid card you will receive an initial $25 balance to put towards your purchases.

Our smartphone are already so smart Isis Mobile Wallet is just the next natural step in making our lives easier and more streamlined. What’s next? Driver’s license on our phone? Stay connected with Isis Wallet on their Facebook Page.

Here is a downloadable/

Here is a downloadable/

She’s spending more time with friends shopping, eating, hanging out on Main Street. She’s got her phone, her iPod and now her own PASS Card from American ExpressSM. All she needs is her license and car and she won’t need Mommy and Daddy anymore; that is until she runs out of money on her PASS Card.

She’s spending more time with friends shopping, eating, hanging out on Main Street. She’s got her phone, her iPod and now her own PASS Card from American ExpressSM. All she needs is her license and car and she won’t need Mommy and Daddy anymore; that is until she runs out of money on her PASS Card.